Monthly personal budget

범주 : 예산

Organize your personal monthly spending and income using this template

A Personal Budget template document is a comprehensive tool used by individuals or households to effectively manage their finances. It is a structured framework that allows individuals to monitor and control their income, expenses, savings, and investments on a regular basis.

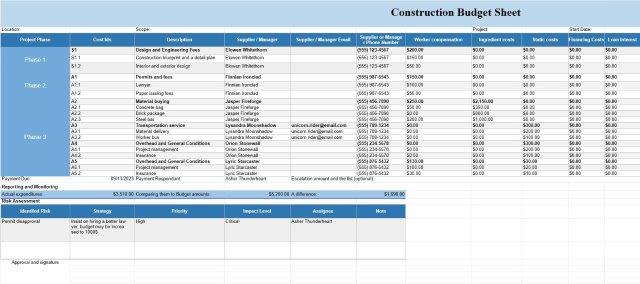

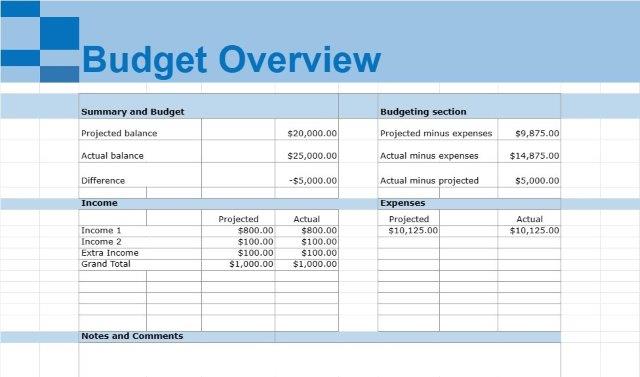

The key components of a Personal Budget template document include:

- Income Tracking: Users can record all sources of income, such as salaries, wages, rental income, interest, and dividends. This section provides a clear overview of the total income available for budgeting.

- Expense Categorization: Expenses are categorized into fixed and variable categories. Fixed expenses include items like mortgage or rent payments, utilities, insurance premiums, and loan repayments. Variable expenses encompass discretionary spending like groceries, dining out, entertainment, and travel.

- Budgeting: The template facilitates the creation of a budget by allowing users to allocate specific amounts to each expense category. This helps in setting spending limits and ensuring that income covers all necessary expenses.

- Savings and Investments: A Personal Budget template document often includes sections for setting savings goals and tracking progress. Users can allocate funds for emergency savings, retirement accounts, investment portfolios, or other financial goals.

- Analysis and Reporting: Users can regularly update the document to record actual income and expenses. By comparing actuals to the budget, individuals can identify areas where they may be overspending or have room for additional savings.

- Financial Goals: The template can also serve as a platform for setting and tracking financial goals. Whether it's paying off debt, saving for a vacation, or investing for retirement, users can document their goals and monitor their progress.

- Emergency Fund: Many Personal Budget templates include a specific section for an emergency fund. This encourages individuals to prioritize saving for unexpected expenses or financial emergencies.

- Debt Management: For those dealing with debt, the template can help manage and track debt repayment plans. It allows users to allocate funds to pay off debts systematically.

- Financial Awareness: Perhaps one of the most significant benefits of using a Personal Budget template document is that it fosters financial awareness. It provides a detailed view of one's financial situation, helping individuals make informed decisions about spending, saving, and investing.

In essence, a Personal Budget template document is a versatile tool that empowers individuals to take control of their finances, set and achieve financial goals, avoid unnecessary debt, and build a secure financial future. It promotes discipline in money management and is an essential resource for financial well-being.

간편한 미리보기 및 스프레드시트 템플릿 다운로드

제한 없이 스프레드시트 템플릿의 전체 버전을 보고 마음에 드는지 확인한 다음 Excel 템플릿을 다운로드하여 장치에 저장하고 무료로 사용할 수 있습니다.

어디서나 스프레드시트 템플릿에 액세스

이는 Windows, MacOS, Linux, iOS와 같은 널리 사용되는 모든 운영 체제에서 작동합니다. 별도의 프로그램 없이 스프레드시트 템플릿을 확인하고 다운로드할 수 있습니다.

템플릿을 사용하는 방법

따라하기 매우 쉬운 단계에 따라 스프레드시트 템플릿을 미리 보고, 다운로드하고, 사용하는 방법을 알아보세요.

더 유사한 템플릿

선택한 것과 동일한 카테고리에 있는 더 많은 스프레드시트 템플릿을 확인하세요.